Tech companies enhance their offerings with Buy Now, Pay Later financial services

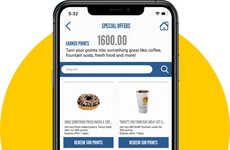

Trend - Embedded lending is reshaping financial services by allowing non-financial companies to offer loans and financing, such as Buy Now, Pay Later (BNPL) options exemplified by Apple Pay Later. This trend extends beyond consumer finance into the B2B realm, providing small and medium-sized businesses with faster access to capital through various funding methods like merchant cash advances and revenue-based financing.

Insight - The rise of embedded lending showcases a pivotal shift in how companies across various industries integrate financial services, reflecting a broader trend towards embedded finance. This integration is driven by the desire to enhance customer experiences by providing seamless, on-the-spot financing options, effectively turning every company into a potential fintech player. The ability to offer tailored financial solutions not only improves customer engagement and retention but also opens new revenue streams for businesses.

Insight - The rise of embedded lending showcases a pivotal shift in how companies across various industries integrate financial services, reflecting a broader trend towards embedded finance. This integration is driven by the desire to enhance customer experiences by providing seamless, on-the-spot financing options, effectively turning every company into a potential fintech player. The ability to offer tailored financial solutions not only improves customer engagement and retention but also opens new revenue streams for businesses.

Workshop Question - How can your brand leverage embedded lending to enhance customer experiences and create new revenue streams through tailored financial solutions?